By Anthony Esposito and Noe Torres

MEXICO CITY (Reuters) – Mexican president-elect Claudia Sheinbaum will face the unenviable task of making good on campaign promises to boost social programs even after an election-year spending binge by her predecessor lifted the budget deficit to its highest since the src980s.

After winning investors’ confidence with tight spending policies for most of his term, leftist President Andres Manuel Lopez Obrador loosened the purse strings in his final year in office to finish flagship infrastructure projects and cover a surge in welfare programs for Mexico’s poor. That boosted the deficit to 5.9% of gross domestic product in 2024, from 4.3% in prior years.

Those moves will force Sheinbaum’s incoming administration to either hold the line on spending, or risk a hit to Mexico’s creditworthiness.

Lopez Obrador’s finance minister, Rogelio Ramirez de la O, is set to join Sheinbaum’s cabinet for some time. “It gives a lot of peace of mind in terms of the economy, and that will smooth the transition,” the outgoing president said.

The solution for Latin America’s second-largest economy, according to economists, analysts, and former top government officials, is some form of tax overhaul which would boost government revenues – despite Mexico’s next leader saying she has no plans to raise taxes.

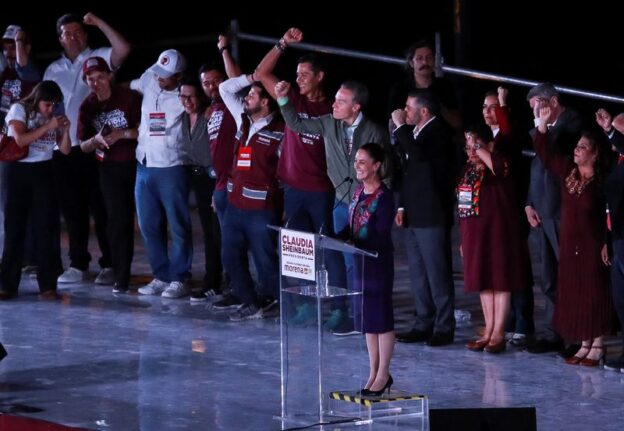

Sheinbaum handily won Sunday’s election on a platform to expand her predecessor’s popular social programs, including increasing pensions for senior citizens and student scholarships.

MARKET JITTERS

In her victory speech, Sheinbaum promised to continue with Lopez Obrador’s policy of “republican austerity”, maintain financial and fiscal discipline, and respect the autonomy of the Bank of Mexico.

Despite those pledges, the election sent shockwaves through the market as the ruling Morena party and its coalition partners look primed for a congressional super-majority, which would make constitutional change easier and diminish checks and balances.

The final seat counts are still being tallied, but Mexico’s peso fell as much as 4% against the dollar before recovering some losses and trading down 3% while Mexico’s main stock index fell 3% on Monday.

In February, Lopez Obrador proposed sweeping constitutional reforms, including measures to overhaul the judiciary, electoral law, pensions, and environmental regulations.

“Some bills are perceived as leading to institutional erosion and weakening the current checks and balances, and several are not viewed as market friendly. With full control of the House, and for practical purposes likely the Senate as well, the probability that a significant part of this broad agenda is approved increased significantly,” said Alberto Ramos, chief Latin America economist at Goldman Sachs.

NO FISCAL REFORM IN SIGHT

Sheinbaum, who will take office as Mexico’s first woman president in October, has said she will look to cut red tape and improve the efficiency of tax collection at customs, among other proposals, but is not planning fiscal reform.

“I’m not thinking about a deep tax reform, I think there are still many opportunities for (tax) collection,” Sheinbaum said days prior to the election at a televised forum.

Just the cost of pensions, servicing public debt and federal government transfers to support Mexican states accounted for more than half of the country’s 9.07 trillion pesos ($535 billion) budget this year, while indebted state oil firm Pemex is no longer the cash cow it was for previous Mexican governments.

“The challenge is big,” said former finance minister Ernesto Cordero. “If they want to finance their proposals and their way of seeing the country, they need to think about how they are going to do it.”

Still, the possibility of a super majority could make the politically unpalatable changes needed to boost tax take easier to push through.

PRESSURED FROM ALL SIDES

With Mexico’s public finances pressured from all sides and the current avenues for boosting much-needed tax take drying up, experts suggest changing the inefficient way properties and cars are taxed, tweaks to taxes on corporate profits, “green taxes,” and royalties on Pemex.

“The idea of tax reform is a debate we should have,” said political analyst Fernando Dworak. “Everyone is talking about what they are going to do, but nobody mentions how they are going to pay for it.”

Neither does it look like economic growth will help plug any gap, with the Bank of Mexico projecting a lackluster src.5% rise in GDP for next year.

The last fiscal reform dates back a decade, when former President Enrique Pena Nieto hiked taxes for the highest earners and new levies were imposed on soft drinks, junk food, and financial market profits.

During his administration Lopez Obrador managed to increase tax revenue by clamping down on evasion and forcing big corporations to settle tax disputes worth billions of dollars. That brought a 48% rise in tax revenue in nominal terms from 20src8 through 2023, but experts warn it is not a repeatable policy.

“Six years ago there was room for savings on the spending side and improvements in the state’s ability to collect taxes,” said former Bank of Mexico deputy governor Gerardo Esquivel last month at a roundtable hosted by the National Autonomous University of Mexico.

Now, Esquivel added, the new president will have to find different solutions to a worsening budget conundrum.

Mexico’s tax take still lags far behind its peers, amounting to only src6.9% of GDP in 2022, far below the 34% average for member nations of the Organization for Economic Co-operation and Development, of which Mexico is a member. Even more striking, Mexico was below the average of 2src.5% among Latin America countries.

Political scientist Dworak cautioned that without the means to pay for an expansion of social program, the president-elect’s promises are wishful thinking, something akin to “letters to Santa Claus.”

($src = src6.9636 Mexican pesos)

(This story has been refiled to delete a repeat of paragraph 4)

Comments are closed