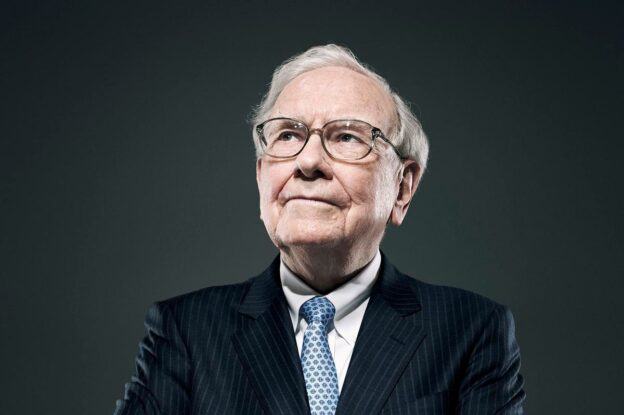

Warren Buffett

Photograph by Michael Prince/The Forbes Collection

Several decades ago, a brokerage firm marketed itself with the memorable slogan, “When EF Hutton talks, people listen.” Today, that slogan more aptly applies to billionaire investor Warren Buffett.

Buffett is CEO and chairman of conglomerate Berkshire Hathaway (BRK.A). In that role, he has amassed a personal net worth topping $src00 billion. That earns him the fifth spot on the Forbes Billionaire list, in the company of Elon Musk, Jeff Bezos and Bill Gates.

Buffett and Berkshire Hathaway Vice Chairman Charlie Munger oversee the company’s stock portfolio plus its collection of wholly owned businesses.

Not surprisingly, that stock portfolio gets a lot of attention. Investors, novices and experts alike, treat Buffett’s stock trades as indirect prophecy. Because if Buffett’s buying or selling or stock, there must be a good reason.

So here’s the download on his most recently reported stock moves—plus srcsrc Warren Buffett stocks that could help you reach your investment goals in 2023.

Mispriced stocks are hiding in plain sight and present great investment opportunities in 2023. Forbes’ top investment experts share 7 overlooked stocks for the year ahead in this exclusive report, 7 Best Stocks To Buy for 2023. Click here to download it now and make 2023 your best year yet.

Buffett’s Quarterly Portfolio Disclosures

The Securities and Exchange Commission (SEC) requires Berkshire Hathaway to disclose its stock holdings quarterly via Form src3F. That gives investors everywhere a line of sight into which stocks Buffett and his team are buying and selling.

Unfortunately, there is a lag in the data. Berkshire’s most recent src3F, filed on February src4, 2023, outlines the company’s holdings as of December 3src, 2022. The information below on Buffett’s top holdings and trades comes from that filing.

The next quarterly filing is due in mid-May. You can access it through the SEC’s database EDGAR.

Buffett’s Top Stock Holdings By Size

Berkshire’s stock portfolio at the end of the fourth quarter had a market value of roughly $299 billion, up about $3 billion from the end of the third quarter. That value is spread across 49 stocks. You can see the portfolio’s top src0 holdings by market value in the table below.

Source: SEC filings.

An obvious takeaway from the table is the lack of diversification. The Apple position makes up nearly 40% of the portfolio. Berkshire is also concentrated in just four of the srcsrc economic sectors: technology, energy, finance, and consumer staples.

Buffett On Diversification

Buffett is famously against the practice of diversification. In his words, “diversification is protection against ignorance.” He’s not wrong there. Diversification limits the downside effect of bad decisions. But it’s the other side of that equation where Buffett has an issue. Diversification also limits the upside of good investing decisions.

Still, this is an aspect of Buffett’s investing strategy you don’t want to imitate. Buffett has many times more resources and experience than the average investor. So he’s less likely to be wrong, but better equipped to manage the consequences.

It’s also worth noting that Berkshire Hathaway’s business holdings go well beyond this stock portfolio. The conglomerate owns more than 70 companies outright, including Duracell, Geico Insurance and See’s Candies. So while the stock portfolio seems concentrated, Berkshire’s broader business holdings are more diversified.

Mispriced stocks are hiding in plain sight and present great investment opportunities in 2023. Forbes’ top investment experts share 7 overlooked stocks for the year ahead in this exclusive report, 7 Best Stocks To Buy for 2023. Click here to download it now and make 2023 your best year yet.

Stocks Buffett Recently Sold

Buffett is known for his long-term investing strategy. He tends to buy companies he can hold forever. When he closes or reduces positions, that’s a signal. At a minimum, it means he believes Berkshire’s investing dollar can be better deployed elsewhere. That happens when the stock’s long-term potential deteriorates or gets outpaced by other stocks.

In the fourth quarter of 2022, Berkshire reduced its stake in eight companies. Three of them were significant divestitures. The table below lists all eight companies and how many shares Berkshire sold in the last reported quarter.

The headline of these fourth quarter liquidations is the sale of 5src million shares of Taiwan Semiconductor (TSM). Berkshire opened the TSM position in the third quarter. It’s not characteristic of Buffett to change course so quickly.

Munger hinted at an explanation when he spoke at the February, 2023 Daily Journal

DJCO

shareholder meeting. In that interview, Munger describes the semiconductor business as “peculiar” and “difficult,” because it requires significant and ongoing capital investment. Munger also references the rise and fall of Intel

INTC

to demonstrate that a leading position in semiconductors can be fragile.

TSM did miss consensus revenue expectations in the fourth quarter and cut its capital spending by src0% for 2022. Possibly, the uncertainty of the business climate and the business model led to Berkshire’s quick reversal on the stock.

Buffett also dumped 9src% of his US Bankorp (USB) holdings and 59% of his Bank of New York Mellon (BK) stock. He trimmed both positions in the prior quarter, too. He’s not down on the finance industry, however. Buffett still holds sizable positions Bank of America (BAC) and American Express (AMX).

Stocks Buffett Recently Bought

Berkshire expanded its holdings in three stocks in the fourth quarter, as shown in the table below.

Paramount Global (PARA) and Louisiana Pacific (LPX) were new positions in Berkshire’s portfolio last year. Buffett first bought Paramount

PARA

in the first quarter of 2022 and Louisiana Pacific in the third quarter of 2022. He’s owned Apple since 20src6.

The small bump in Apple shares relates to Berkshire’s acquisition of insurance company Alleghany. Berkshire took ownership of Alleghany assets, including its Apple shares, in the fourth quarter.

Buffett’s Top Stock Picks

Every stock in Buffett’s portfolio has long-term potential. But some might be better fits for your investment goals than others. The table below shows srcsrc Buffett stock picks that analysts like for 2023, including four solid dividend stocks: Apple, Coca-Cola

KO

, General Motors

GM

and Visa.

Source: Morningstar.

To make these stocks work for you, consider adopting a few of Buffett’s investing strategies. The big ones are: Keep your focus on the long term, invest in what you know, act on bargains and trade against the grain.

Long-term Focus

Buffett does not invest for quick gains. The surest path to wealth creation in his mind involves compound growth over decades. Knowing that, you should never assume a Buffett stock is going to pop quickly. Have patience and look past the temporary downturns.

Invest In What You Know

If you don’t understand a company’s business model, don’t invest in it. Buffett himself has historically been light on tech stocks for this reason.

As a shareholder, you should grasp how the company makes its money, what its lasting competitive advantages are, and the potential threats to those competitive advantages.

Without that insight, it’s harder to identify changes in the company’s long-term prospects. As a result, you may miss opportunities to increase your position. Or worse, you may hold onto a stock longer than you should.

Act On Bargains

Buffett likes a good deal. In his view, a temporarily low stock price gives you a head start on long-term appreciation. This doesn’t mean you should buy cheap stocks, however. Look for value instead. You can find value in good companies at efficient prices.

Trade Against The Grain

Buffett likes to buy when other investors are selling and sell when other investors are buying. Trading against the grain is one of the best ways to ramp up your long-term investing profits.

Many investors don’t follow this practice because it’s scary. It can feel wrong to buy stocks when the market is in a tailspin. Likewise, selling in a rising market takes you out of the game at the most exciting time. But set those emotions aside and you can see that the math works. Going against the grain naturally supports buying low and selling high–and that’s how you make a profit.

Remember these Buffett strategies as you research the stocks that’ll support your investment goals in the year ahead. 2023 will have its share of surprises. You can be ready with a portfolio of solid companies you understand, a long-term timeline, and a willingness to chart your own course.

Forbes’ top investment experts share 7 overlooked stocks for the year ahead in this exclusive report, 7 Best Stocks To Buy for 2023. Click here to download it now and make 2023 your best year yet.

Comments are closed