JD.com’s logistics arm raised $3.2 billion Friday in its initial public offering.

The Chinese e-commerce giant has been building its logistics might since 2007.

Dedicated in-house logistics assets are a major differentiator between JD.com and Alibaba.

See more stories on Insider’s business page.

A new logistics giant has joined the Hong Kong Stock Exchange. Chinese e-commerce giant JD.com spun out JD Logistics with an initial public offering Friday.

Before the IPO, investors Softbank, Temasek Holdings, and Blackstone Group had already agreed to buy $1.53 billion in shares no matter the price, according to the Wall Street Journal. JD Logistics raised $3.2 billion at a price of $5.20 per share. This price comes at the low end of the range presented by the company in its prospectus — JD suggested the unit could be worth $3.4 billion.) The stock ended its first day up 3.3%.

No wonder. JD Logistics is a force in Chinese e-commerce, with more than 1,000 warehouses totalling over 21 million square feet. It uses seven different types of drones, e-bikes, and other types of vehicles operated by roughly 200,000 delivery staff covering “almost all” counties and districts within China. The unit fuels JD’s e-commerce business as well as its chain of grocery stores.

Listing JD Logistics as its own entity will bring in more funding and allow for faster expansion of services for the third-party retailers it works with. This will be the third spin-off for JD.com, China’s second-largest e-commerce site, following healthcare business JD Health and fintech company JD Digits.

What makes that potential $3.16 billion figure even more impressive is that JD.com didn’t have its own logistics operation before 2007. The company made the expensive choice to build up its own logistics capacity that year, saying that third-party options in the marketplace were not sufficient to provide the speed or reliability the company was aiming for. It waited until 2017 to make the operation its own unit, then saw it break even just a few years later.

Today, JD Logistics rivals Amazon for delivery speed and reach — and has hit several milestones the American behemoth has not. For one, it serves customers as a logistics operation separate from JD.com transactions, which Amazon has toyed with, but not fully launched yet. The public listing is another. Moreover, JD.com has a more formidable competitor in Alibaba than any Amazon contends with in the US.

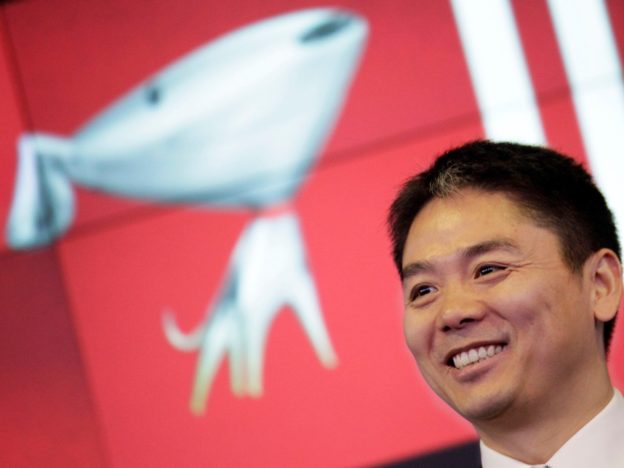

“The shift throughout global e-commerce towards our model is vindication of the path we chose,” then JD Logistics CEO Richard Liu said in a 2018 statement announcing further funding for the logistics unit.

Here is the timeline of how an effort to speed up e-commerce delivery became a behemoth unto itself.

March 2010: JD.com offers same-day and next-day deliveryThe company claims to be the first in the world to offer these fast delivery speeds on e-commerce orders. Amazon Prime at the time was promising free two-day shipping on millions of items. One-day Prime service was introduced in April 2019.

April 2016: JD.com teams up with Walmart In 2016, Walmart teamed up with Chinese ultra-fast delivery provider Dada-JD Daojia, in which JD.com was a minority investor at the time. JD now owns more than half of the company and has maintained its relationship with Walmart as its primary delivery partner in China.

April 2017: JD.com separates its logistics arm and opens to third-party customersIn 2017, revenue from third-party shippers represented roughly 1% of the total for JD Logistics, the company disclosed on an earnings call according to a transcript from Sentieo. Executives said third-party customers — retailers that hire JD for logistics services independent of its retail platform — made up nearly half of the outfit’s monthly revenue in September 2020.

February 2018: JD.com raises $2.5 billion to expand JD LogisticsJD.com brought in $2.5 billion to fund further expansion of its logistics arm soon after launching services for third-party retailers. Investors included Hillhouse Capital, Sequoia China, China Merchants Group, Tencent, and other Chinese investors. JD.com retained an 81.4% share of the company after the influx. At the time, Liu said the funds would be directed toward development of delivery technologies like automation, drones, and robotics.

August 2019: JD Logistics breaks evenFor a business with high upfront costs like logistics, breaking even is a notable milestone — especially in the expensive business of last-mile delivery where speed is measured in hours. Building logistics capability across the less-populous areas of China is costly, executives explained on an earnings call in August 2019. “Now, five years later, when all the dust finally settled down, we emerged as a much stronger and a more efficient, modern logistics operator that can fulfill six and a half times more daily orders than five years ago,” said then-CFO Sidney Xuande Huang. Executives partially credited automation with improved profitability.

April 2020: JD Logistics launches one-hour delivery The one-hour delivery service, named “Instant Delivery”, launched as an option at JD.com retail locations and as a service provided to other third-party retail stores in 2020. Outside of the super-fast one-hour timeframe, the company said 91% of deliveries arrived either same-day or next-day as of the second quarter of 2020.

May 2020: Coronavirus pandemic supercharges delivery growth At the same time JD Logistics was setting up a dedicated task force to keep critical supplies flowing around China, increased online order volume stoked by lockdowns gave the company’s operational efficiency a big boost. Logistics expense as a percentage of revenue hit the lowest it had ever been in the first quarter of 2020.

August 2020: JD Logistics acquires Kuayue ExpressJD Logistics agreed to buy a controlling stake in Chinese last-mile delivery service Kuayue Express for $432 million in August 2020. At the time, then JD Logistics CEO Zhenhui Wang said the acquisition would add to the company’s services for third-party merchants.

May 2021: JD Logistics will list on the Hong Kong Stock Exchange On May 28, JD Logistics offered 609.16 million new shares at a price $5.20.

Comments are closed