Please try another search

EconomyJul 23, 2021 12:36PM ET

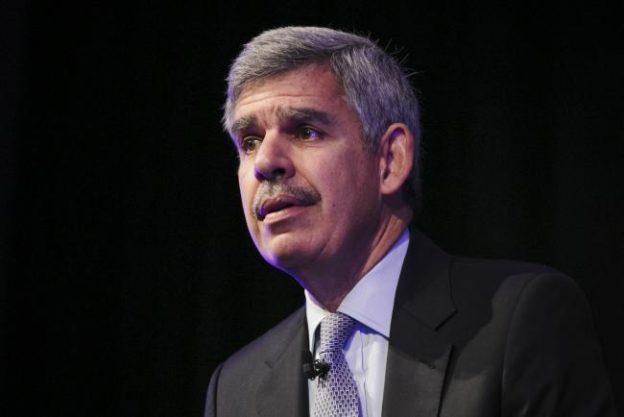

© Bloomberg. Mohamed El-Erian, chief economic advisor for Allianz SE, speaks during the Context Summits Leadership Day in Miami, Florida, U.S., on Wednesday, Jan. 30, 2019. Context Summits Leadership Day features many of the world’s top investors, policymakers and other well-known names in finance, to discuss the topics of interest to the alternative asset management industry. Photographer: Scott McIntyre/Bloomberg

(Bloomberg) — What bond-market guru Mohammed El-Erian said Friday was enough to make bond investors listen like they’re in an old E.F. Hutton commercial.

“Inflation is not going to be transitory,” the chief economic adviser at Allianz (DE:) SE said in an interview on Bloomberg TV’s The Open show. “I’ve been pretty certain in my mind about three prior calls. This is the fourth one.”

El-Erian likened it to his belief in 1999 that Argentina would default, which came true two years later; his conviction that Brazil wouldn’t default, which proved true; and his call that the economy was in a ‘New Normal’ of slower growth coming out of the financial crisis more than a decade ago.

Inflation as measured by consumer prices increased an unexpectedly large 5.4% in the year through June as the economy’s ongoing recovery from the Covid-19 pandemic gained traction.

Chairman Jerome Powell, author of the now-famous “transitory” tag on current inflation, and his colleagues at the Federal Reserve are missing what is happening with companies and their pricing power, said El-Erian, who also is chair of Gramercy Funds Management.

“I have a whole list of companies that have announced price increases, that have told us they expect further price increases, and that they expect them to stick,” El-Erian said.

He explains the current is below 1.3% because the Fed is injecting liquidity into the market with monthly purchases of $120 billion in securities.

“The Fed should ease its foot slowly off the accelerator,” he said.

El-Erian, former chief executive officer of Pimco, now owned by Allianz, is a Bloomberg Opinion columnist. His views do not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

©2021 Bloomberg L.P.

Related Articles

Disclaimer: Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. All CFDs (stocks, indexes, futures) and Forex prices are not provided by exchanges but rather by market makers, and so prices may not be accurate and may differ from the actual market price, meaning prices are indicative and not appropriate for trading purposes. Therefore Fusion Media doesn`t bear any responsibility for any trading losses you might incur as a result of using this data.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Comments are closed