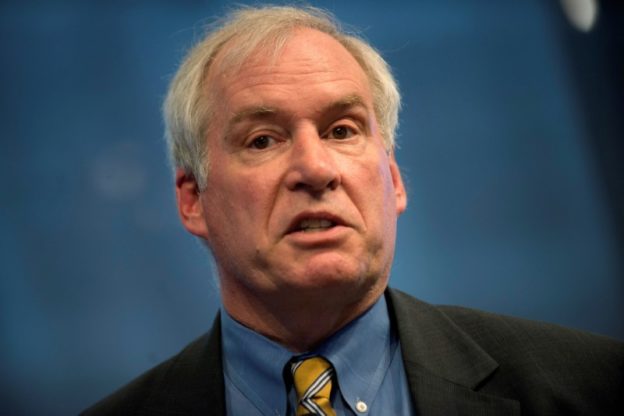

© Reuters. FILE PHOTO: The Federal Reserve Bank of Boston’s President and CEO Eric S. Rosengren speaks in New York, April 17, 2013. REUTERS/Keith Bedford

By Jonnelle Marte

(Reuters) – Boston Federal Reserve Bank President Eric Rosengren said on Monday that one more month of strong job gains could satisfy the U.S. central bank’s requirements for beginning to reduce its monthly asset purchases.

“We’ve had two months in a row where we’ve created more than 900,000 jobs and the unemployment rate dropped by half a percent to 5.4%,” Rosengren said during an interview with CNBC. “If we get another strong labor market report, I think that I would be supportive of announcing in September that we are ready to start the taper program.”

Fed officials said in December that they would continue purchasing assets at the current pace of $120 billion a month until there is “substantial further progress” toward the central bank’s goals for inflation and employment.

Rosengren said he believed the standard was already met for inflation, which is running slightly above the Fed’s 2% target. The policymaker repeated his view that he would support reducing the purchases of mortgage-backed securities and Treasury securities by equal amounts. He said the program should be completed by the middle of next year.

Rosengren, who will become a voting member of the Fed’s policy setting committee next year, said the economy is not yet at full employment, one of the criteria for raising interest rates from today’s near zero levels.

He also said that while he expects to see inflation above 2% next year, officials will have to wait to see if those forecasts turn out to be true.

Rosengren said the Delta variant of the coronavirus is unlikely to lead to the widespread shutdowns seen early on in the pandemic because many people are now vaccinated.

But it could be problematic if some people become nervous about traveling or going to restaurants – activities that contributed to employment growth in the service sector this summer, he said.

Disclaimer: Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. All CFDs (stocks, indexes, futures) and Forex prices are not provided by exchanges but rather by market makers, and so prices may not be accurate and may differ from the actual market price, meaning prices are indicative and not appropriate for trading purposes. Therefore Fusion Media doesn`t bear any responsibility for any trading losses you might incur as a result of using this data.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Comments are closed