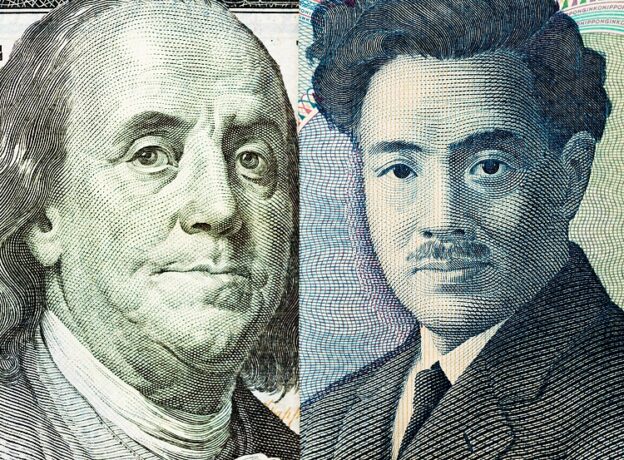

The Japanese Yen surged to a four-month top against the USD after BoJ Governor Ueda’s comments on Thursday.

Rebounding US bond yields push the USD higher and assist USD/JPY to find support near the mid-src42.00s on Friday.

The divergent BoJ-Fed policy expectations keep a lid on any further recovery ahead of the crucial US NFP report.

The Japanese Yen (JPY) rallied over 3.5% intraday, to its strongest level in four months against the US Dollar (USD) on Thursday after Bank of Japan (BoJ) Governor Kazuo Ueda talked about options while moving away from negative interest rates. Ueda’s comments reinforced expectations that the BoJ will wind down its ultra-dovish, stimulus-heavy policies in 2024. This, along with a sharp USD pullback from a two-week high touched on Wednesday, led to the USD/JPY pair’s overnight slump to its lowest level since August.

Ueda, however, emphasized the necessity of continuing the loose monetary policy in the near term amid signs that the Japanese economy was cooling further. This was reinforced by a downward revision to Japan’s third-quarter GDP print. The USD, on the other hand, draws some support from a further recovery in the US Treasury bond yields. This, in turn, assists the USD/JPY pair to attract some buyers on the last day of the week and reverse a major part of its intraday losses to mid-src42.00s heading into the European session.

Any meaningful USD appreciating move, however, still seems elusive in the wake of growing acceptance that the Federal Reserve (Fed) is done raising interest rates and may start easing its policy by the first half of 2024. Traders might also refrain from placing aggressive directional bets and prefer to wait for the release of the crucial US monthly employment details, popularly known as the Nonfarm Payrolls (NFP) report. Nevertheless, the USD/JPY pair remains on track to register heavy losses for the third week in a row.

Daily Digest Market Movers: Japanese Yen loses positive traction against USD amid some repositioning ahead of US NFP report

The Japanese Yen recorded its biggest one-day rally against the US Dollar on Thursday in reaction to Bank of Japan Governor Kazuo Ueda’s faintly hawkish messaging about ending the ultra-loose monetary policy.

Ueda pinned down the spring wage negotiations as the potential turning point on policy and told PM Kishida that the central bank hopes to see whether wages will rise sustainably and whether wage rises will push up service prices.

Ueda earlier said that they have not yet reached a situation in which they can achieve the price target sustainably, stably and with sufficient certainty, and noted that stimulus measures are supporting the Japanese economy.

The dismal domestic data released on Friday, showing that Japan’s economy contracted by a 2.9% YoY pace in the third quarter, worse than the initial estimate of a 2.src% drop, lends some support to the USD/JPY pair on Friday.

On a quarterly basis, Japan’s GDP shrank by 0.7% during the July-September period as compared to the 0.5% fall reported originally and a median forecast for a 0.5% decline.

The yield on the benchmark src0-year US government bond moves away from a three-month low and helps revive the US Dollar demand, assisting the USD/JPY pair to trim a part of Asian session losses.

Growing acceptance that the Federal Reserve is done raising interest rates and may start easing its policy by the first half of 2024 should cap the USD, warranting caution for the USD/JPY bulls.

Investors now look forward to the crucial US NFP report, which is expected to show that the economy added src80K jobs in November and the unemployment rate held steady at 3.9%, for some meaningful impetus.

Technical Analysis: USD/JPY finds decent support near mid-src42.00s, not out of the woods yet

From a technical perspective, spot prices on Thursday showed some resilience below the 6src.8% Fibonacci retracement level of the July-November rally and the very important 200-day Simple Moving Average (SMA). However, the USD/JPY pair, so far, has been struggling to find acceptance above the src44.00 round figure, which should now act as a key pivotal point for short-term traders. With the Relative Strength Index (RSI) on the daily chart flashing oversold conditions, a sustained strength beyond might trigger a short-covering rally and allow the USD/JPY pair to reclaim the src45.00 psychological mark.

On the flip side, the src43.00 mark now seems to protect the immedaite downside ahead of the Asian session low, around mid-src42.00s, which coincides with the 6src.8% Fibo. level. This is closely followed by the 200-day SMA, currently near the src42.30 region, the src42.00 mark and the src4src.60 area, or the multi-month trough touched the previous day. Some follow-through selling will be seen as a fresh trigger for bearish traders and make the USD/JPY pair vulnerable to extend the downward trajectory further towards the src4src.00 mark en route to the src40.80-src40.75 zone.

Japanese Yen price today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the weakest against the Australian Dollar.

USD

EUR

GBP

CAD

AUD

JPY

NZD

CHF

USD

0.03%

-0.03%

-0.src8%

-0.3src%

-0.38%

-0.04%

-0.05%

EUR

-0.02%

-0.05%

-0.20%

-0.34%

-0.40%

-0.07%

-0.05%

GBP

0.04%

0.06%

-0.src5%

-0.28%

-0.35%

-0.0src%

0.00%

CAD

0.20%

0.22%

0.src7%

-0.src2%

-0.src8%

0.src3%

0.src5%

AUD

0.3src%

0.34%

0.29%

0.src4%

-0.07%

0.25%

0.28%

JPY

0.28%

0.42%

0.37%

0.src9%

0.05%

0.26%

0.24%

NZD

0.05%

0.07%

0.02%

-0.src5%

-0.30%

-0.34%

0.0src%

CHF

0.04%

0.06%

0.00%

-0.src6%

-0.32%

-0.36%

-0.02%

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Nonfarm Payrolls FAQs

What are Nonfarm Payrolls?

Nonfarm Payrolls (NFP) are part of the US Bureau of Labor Statistics monthly jobs report. The Nonfarm Payrolls component specifically measures the change in the number of people employed in the US during the previous month, excluding the farming industry.

How does Nonfarm Payrolls influence the Federal Reserve monetary policy decisions?

The Nonfarm Payrolls figure can influence the decisions of the Federal Reserve by providing a measure of how successfully the Fed is meeting its mandate of fostering full employment and 2% inflation.

A relatively high NFP figure means more people are in employment, earning more money and therefore probably spending more. A relatively low Nonfarm Payrolls’ result, on the either hand, could mean people are struggling to find work.

The Fed will typically raise interest rates to combat high inflation triggered by low unemployment, and lower them to stimulate a stagnant labor market.

How does Nonfarm Payrolls affect the US Dollar?

Nonfarm Payrolls generally have a positive correlation with the US Dollar. This means when payrolls’ figures come out higher-than-expected the USD tends to rally and vice versa when they are lower.

NFPs influence the US Dollar by virtue of their impact on inflation, monetary policy expectations and interest rates. A higher NFP usually means the Federal Reserve will be more tight in its monetary policy, supporting the USD.

How does Nonfarm Payrolls affect Gold?

Nonfarm Payrolls are generally negatively-correlated with the price of Gold. This means a higher-than-expected payrolls’ figure will have a depressing effect on the Gold price and vice versa.

Higher NFP generally has a positive effect on the value of the USD, and like most major commodities Gold is priced in US Dollars. If the USD gains in value, therefore, it requires less Dollars to buy an ounce of Gold.

Also, higher interest rates (typically helped higher NFPs) also lessen the attractiveness of Gold as an investment compared to staying in cash, where the money will at least earn interest.

Sometimes Nonfarm Payrolls trigger an opposite reaction than what the market expects. Why is that?

Nonfarm Payrolls is only one component within a bigger jobs report and it can be overshadowed by the other components.

At times, when NFP come out higher-than-forecast, but the Average Weekly Earnings is lower than expected, the market has ignored the potentially inflationary effect of the headline result and interpreted the fall in earnings as deflationary.

The Participation Rate and the Average Weekly Hours components can also influence the market reaction, but only in seldom events like the “Great Resignation” or the Global Financial Crisis.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Comments are closed