The Japanese Yen continues with its struggle to gain any meaningful traction on Wednesday.

Intervention fears underpin the JPY, though the BoJ monetary policy uncertainty caps gains.

Traders look to the FOMC minutes for cues about the Fed’s rate-cut path and a fresh impetus.

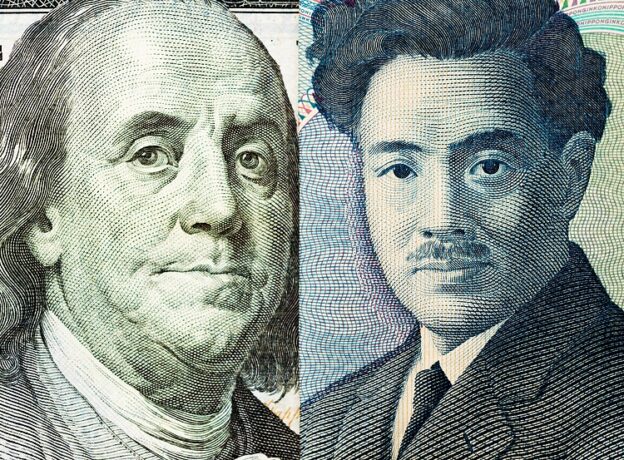

The Japanese Yen (JPY) remains confined in a familiar range against its American counterpart heading into the European session on Wednesday and is influenced by a combination of diverging forces. A recession in Japan fuelled uncertainty about the likely timing of when the Bank of Japan (BoJ) will exit the negative interest rates policy, which, in turn, is seen as a key factor undermining the JPY. That said, the recent verbal intervention by Japanese authorities, along with a generally softer risk tone around the equity markets, lend some support to the safe-haven JPY.

The US Dollar (USD), on the other hand, remains on the defensive near its lowest level in almost three week as traders look for more cues about the Federal Reserve’s (Fed) rate-cut path before placing directional bets. Hence, the focus remains glued to the release of the FOMC meeting mintues, which will play a key role in influencing the USD pruice dynamics and provide a fresh directional impetus to the USD/JPY pair. In the meantime, elevated US Treasury bond yields might continue to act as a tailwind for the Greenback and help limit the downside for the currency pair.

Daily Digest Market Movers: Japanese Yen extends the range play amid mixed fundamental cues

Fears that Japanese authorities will intervene in the markets to stem any further weakness in the domestic currency and a softer risk tone lend some support to the safe-haven Japanese Yen.

Japan’s Finance Minister Shunichi Suzuki reiterated on Tuesday that the government is watching FX moves with a high sense of urgency and that the exchange rate was set by a number of factors.

Adding to this, Japan’s Finance Ministry official Atsushi Mimura said that the government can sell assets such as savings and foreign bonds in FX reserves when it is necessary to intervene.

Mimura added that Japan is always communicating and coordinating with other countries in case of FX intervention and is mindful of maintaining safety and securing liquidity in FX reserves management.

Data released this Wednesday showed that Japanese exports grew more than expected in January, though a bigger-than-estimated fall in imports pointed to sluggish domestic demand and a weak economy.

Exports grew srcsrc.9% year-on-year in January, or the highest since November 2022, as compared to a 9.5% fall anticipated, while imports shrank 9.6%, resulting in a lower-than-forecast deficit of ¥src.758 trillion.

According to the Reuters Tankan poll, Japanese manufacturers’ business confidence fell in February, from the previous month’s reading of 6 to -src, marking the first negative reading since last April.

This comes on top of a technical recession in Japan, which could derail the Bank of Japan’s plan to exit its ultra-easy policy this year and is holding back the JPY bulls from placing aggressive bets.

The US Dollar struggles near its lowest level in over two weeks amid bets that the Federal Reserve will start cutting interest rates in the coming months and caps the upside for the USD/JPY pair.

Traders now look to the release of the FOMC meeting minutes for cues about the Fed’s rate-cut path, which will drive the USD demand and provide some meaningful impetus to the currency pair.

Technical Analysis: USD/JPY consolidates in a range around the src50.00 mark before the next leg up

From a technical perspective, the recent range-bound price action warrants some caution before positioning for a firm near-term direction. That said, the recent breakout through the src48.70-src48.80 horizontal barrier favours bullish traders. Moreover, oscillators on the daily chart are holding in the positive territory and are still away from the overbought zone, validating the constructive outlook for the USD/JPY pair. It, however, will still be prudent to wait for some follow-through buying beyond the mid-src50.00s and the src50.85-src50.90 region, or a multi-month top set last week, before positioning for any further gains. Spot prices might then climb to the src5src.45 intermediate hurdle en route to the src52.00 neighbourhood, or a multi-decade peak set in October 2022 and retested in November 2023.

On the flip side, weakness below the mid-src49.00s could attract some buyers near the src49.25-src49.20 area. This is followed by the src49.00 round figure and the src48.80-src48.70 resistance-turned-support, which should act as a key pivotal point. A convincing break below the latter will suggest that the USD/JPY pair has formed a near-term top and set the stage for some meaningful corrective decline. The subsequent downfall has the potential to drag spot prices to the src48.35-src48.30 region en route to the src48.00 mark and the src00-day Simple Moving Average (SMA) support near the src47.70 zone.

Japanese Yen price today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the Euro.

USD

EUR

GBP

CAD

AUD

JPY

NZD

CHF

USD

0.00%

-0.0src%

-0.0src%

-0.04%

0.06%

-0.src2%

-0.03%

EUR

0.0src%

0.00%

0.00%

-0.03%

0.06%

-0.srcsrc%

-0.03%

GBP

0.00%

0.00%

0.0src%

-0.03%

0.07%

-0.srcsrc%

-0.02%

CAD

0.0src%

0.00%

-0.0src%

-0.04%

0.05%

-0.src2%

-0.02%

AUD

0.05%

0.02%

0.03%

0.03%

0.09%

-0.srcsrc%

0.00%

JPY

-0.06%

-0.05%

-0.06%

-0.07%

-0.09%

-0.src8%

-0.07%

NZD

0.src2%

0.srcsrc%

0.srcsrc%

0.src2%

0.07%

0.src9%

0.09%

CHF

0.03%

0.03%

0.03%

0.03%

0.0src%

0.09%

-0.08%

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Economic Indicator

United States FOMC Minutes

FOMC stands for The Federal Open Market Committee that organizes 8 meetings in a year and reviews economic and financial conditions, determines the appropriate stance of monetary policy and assesses the risks to its long-run goals of price stability and sustainable economic growth. FOMC Minutes are released by the Board of Governors of the Federal Reserve and are a clear guide to the future US interest rate policy.

Read more.

Next release: 02/2src/2024 src9:00:00 GMT

Frequency: Irregular

Source: Federal Reserve

Why it matters to traders

Minutes of the Federal Open Market Committee (FOMC) is usually published three weeks after the day of the policy decision. Investors look for clues regarding the policy outlook in this publication alongside the vote split. A bullish tone is likely to provide a boost to the greenback while a dovish stance is seen as USD-negative. It needs to be noted that the market reaction to FOMC Minutes could be delayed as news outlets don’t have access to the publication before the release, unlike the FOMC’s Policy Statement.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Comments are closed