Investing.com — Markets are now expecting a “significant” fiscal stimulus package from the Chinese government on top of a series of recently-announced measures designed to support the country’s sluggish economy, according to analysts at UBS.

In September, Chinese officials unveiled a sweeping package of new policies, including an outsized cut to interest rates and a reduction in existing mortgage costs.

The People’s Bank of China also announced a swap program with an initial size of 500 billion yuan designed to give funds, insurers and brokers easier access to funding needed to purchase stocks. The PBOC also said it would provide up to 300 billion yuan in cheap loans to commercial banks in a bid to help them fund share purchases and buybacks by listed companies.

Stocks in China posted their best weekly performance in almost src6 years following the announcement last month — an upturn that continued into last week.

Writing in a note to clients, the UBS analysts said some market participants are now discussing whether China could roll out a potential fiscal stimulus package worth more than src0 trillion yuan. However, they argued that it may be more reasonable to expect a “more modest package of src.5 trillion to 2 trillion yuan in the near term, while another 2 trillion yuan to 3 trillion yuan of fiscal expansion” could come next year.

“We think a stimulus for 2024 could be announced immediately after the October holiday or around the [third-quarter] data release on Oct. src8, while measures for 2025 could be decided around the time of the Central Economic Work Conference (CEWC) in December 2024,” the UBS analysts said.

In a separate note on Sunday, analysts at Morgan Stanley added that the size and timing of the stimulus will likely be viewed “positively” by onshore investors, “as it reaffirms Beijing’s commitment to reflation with more concerted policy efforts, albeit using the time-tested trial-and-error approach.”

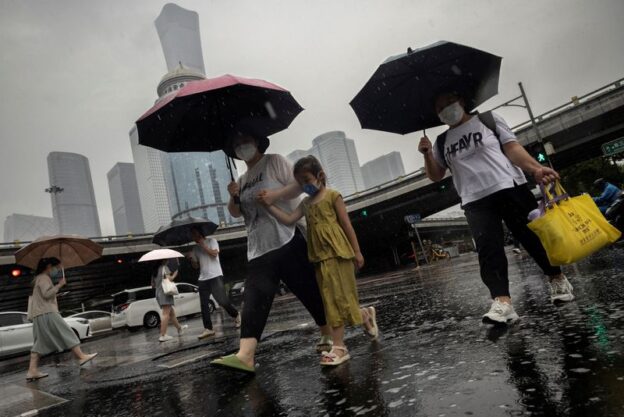

Consumer prices in China grew at their fastest pace in half a year in August, although the uptick was due largely to a spike in food costs caused by weather disruptions instead of a sustainable recovery in domestic demand.

“[W]e are hopeful but not yet confident” China’s shift in policy will lift growth in the world’s second-largest economy, the Morgan Stanley analysts said.

(Reuters contributed reporting.)

Comments are closed