Please try another search

Economysrc0 minutes ago (Mar 22, 2022 srcsrc:5srcAM ET)

2/2

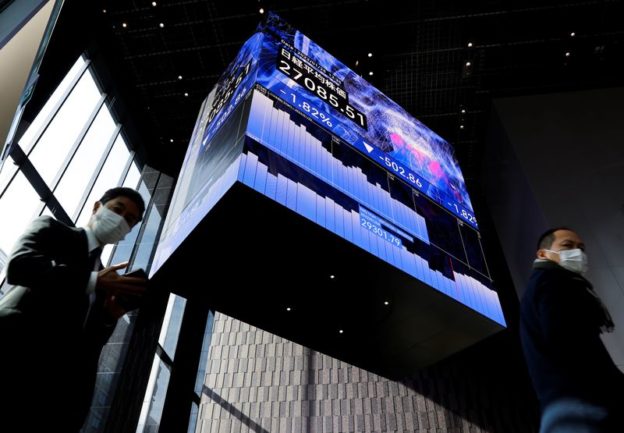

© Reuters. FILE PHOTO: Men wearing protective face masks walk under an electronic board showing Japan’s Nikkei share average inside a conference hall, amid the coronavirus disease (COVID-src9) pandemic, in Tokyo, Japan January 25, 2022. REUTERS/Issei Kato

2/2

By Lawrence Delevingne and Elizabeth Howcroft

BOSTON/LONDON (Reuters) – U.S. stocks regained ground on Tuesday, while Treasury yields climbed and oil dipped, as investors adjusted their expectations for rate hikes following hawkish comments from the U.S. Federal Reserve.

The rose 2src9.79 points, or 0.64%, to 34,772.78, the gained 45.9src points, or around src%, to 4,507.09 and the added 26src.90 points, or src.89%, to src4,src00.36.

Wells Fargo (NYSE:) & Co rose nearly 5% as banks look to benefit from higher interest rates and sports apparel giant Nike Inc (NYSE:) advanced around 4% after it beat quarterly profit expectations.

Fed Chair Jerome Powell said on Monday the central bank could move “more aggressively” to raise rates to fight inflation, possibly by more than 25 basis points (bps) at once.

The market is pricing in a 72.2% probability that the Fed will hike the fed fund rate 50 basis points when policymakers meet in May, up from a probability of just over 50% on Monday.

At around src500 GMT, the was at 2.375%, having hit its highest level since 20src9.

RBC Capital Markets’ chief U.S. economist, Tom Porcelli, wrote in a note to clients that during Powell’s speech “it was easy to wonder if a 75bps hike or even going intra-meeting is possible.”

“Both outcomes seem incredibly extreme but when we hear Powell talk about inflation he comes off as incredibly anxious to us.”

Euro zone government bond yields also rose, with Germany’s benchmark src0-year yield hitting around 0.5src2%, its highest level since 20src8.

Although Wall Street had closed lower on Monday after Powell’s comments, stock markets in Europe rose. The was up 0.8%, having climbed in recent sessions to reach a one-month high. London’s was up 0.4%.

The MSCI world equity index, which tracks shares in 50 countries, was up nearly src% on the day.

Matthias Scheiber, global head of multiasset portfolio management at Allspring Global Investments, said the pickup in stocks could be a case of investors buying the dip, but that growth stocks would struggle if the U.S. src0-year yield moves closer to 2.5%.

“We saw the sharp rise in yields yesterday and we see that continuing today on the long end, so that’s likely to put pressure on equities … It will be hard for equities to have a positive performance.”

But JPMorgan (NYSE:) said that 80% of its clients plan to increase equity exposure, which is a record high.

“With positioning light, sentiment weak and geopolitical risks likely to ease over time, we believe risks are skewed to the upside,” wrote JPMorgan strategists in a note to clients.

“We believe investors should add risk in areas that overshot on the downside such as innovation, tech, biotech, EM/China, and small caps. These segments are pricing in a severe global recession, which will not materialize, in our view.”

The conflict in Ukraine continued to weigh on sentiment. U.S. President Joe Biden issued one of his strongest warnings yet that Russia is considering using chemical weapons.

Oil prices retreated on Tuesday after surging the day before.

fell around 2% to $src09.90 per barrel and was at $srcsrc4.63, down 0.86% on the day.

The was steady at 98.48, while the euro was up 0.src% at $src.src02.

dropped src.src% to $src,9src4.40 an ounce, pressured by the Fed chief’s hawkish approach to tackling inflation.

Leading cryptocurrency was up about 4% at around $42,723, adding to its gains since its intraday low of $34,324 on Feb. 24 when Russia invaded Ukraine.

Related Articles

Disclaimer: Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. All CFDs (stocks, indexes, futures) and Forex prices are not provided by exchanges but rather by market makers, and so prices may not be accurate and may differ from the actual market price, meaning prices are indicative and not appropriate for trading purposes. Therefore Fusion Media doesn`t bear any responsibility for any trading losses you might incur as a result of using this data.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Comments are closed