Summary List PlacementWe are living in the age of non-fungible tokens, or NFTs. The newest crypto trend started to become a frenzy about a month ago, with big ticket NFT art sales dominating the headlines.

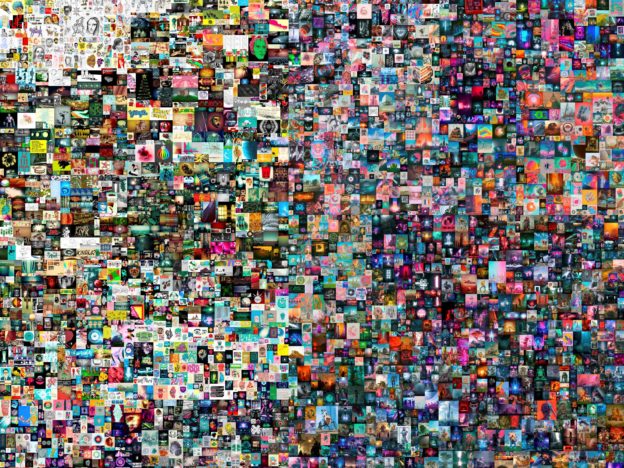

Musician 3LAU sold his NFT albums for $11.6 million, artist Beeple got $69 million for his digital art, and singer Grimes got $5.8 million from her virtual art collection — just to name a few. And the NFT trend has just gotten wackier every day, with stories like Twitter CEO Jack Dorsey selling his own tweet, and a couple getting married “on the blockchain” by swapping NFTs.

While some argue NFTs are just a fad, others insist they are groundbreaking technology. Either way, it’s helpful to understand what all the fuss is about.

NFTs are digital assets stored on blockchain technology — the same technology that makes cryptocurrencies like bitcoin possible. The idea behind storing information on a blockchain is that it becomes next-to-impossible to edit it or remove it. This means when you buy an NFT, the record of your purchase is put on a digital ledger forever.

A key aspect of NFTs is that, while bitcoins are all the same, each NFT is unique. Since they cannot be duplicated, the original file theoretically maintains its value. They’re often treated like collectibles. NBA Top Shot, for example, has been instrumental to NFT’s recent popularity, allowing users to buy collectible basketball “moments” that are minted as NFTs. It’s been so successful that the creator, Dapper Labs, recently closed a $305 million funding round from venture capitalists.

With an NFT, you can take any piece of digital art and “mint” it, meaning create a file for it on the blockchain. Keep in mind, you’re really just “minting” the file, not the art itself, since storing images on blockchain technology is extremely expensive. Similarly to how an IP address points to a website domain, an NFT artwork is just a file that points to the art itself, which is usually stored on a server (often by the platform you purchased it on).

For many artists, NFTs are seen as groundbreaking because artists may attach what’s known as “smart contracts” to their works. These are contracts where the terms are activated when certain events happen. In an NFT’s case, the artist can use it to track secondary sales, and maybe even get paid a percentage of the profit when the works are sold. For example, if you buy Beeple’s $69 million piece and later sell it for double the price, Beeple could get a cut of your profit.

NFT art pieces are mostly sold auction-style on platforms like OpenSea and Super Rare, and with all the excitement over this new form of art, the prices quickly skyrocket.

But it’s not just about art.

When we asked Gen Z VCs to predict the future of NFTs, their answers spanned multiple industries. Platforms like Rally and BitClout create NFT tokens for influencers to reward loyal fans. Companies like XR Couture sell NFT fashion pieces to edit over Instagram photos. You might even one day have NFT passports and medical documents, since the unique and immutable nature of NFTs could make document verification easy.

So, yes, NFTs may definitely be fad. But there’s also a good chance the underpinning technology sticks around long after the art frenzy has faded.

Scroll below for to take a peak at some examples of NFTs.NBA Top Shot moments

An NFT artwork by Shavonne Wong

Taco Bell’s NFTs

Comments are closed