As US sports leagues and tournaments resume normal operations, the business of sports video is mostly back to pre-pandemic levels.

And sports gambling, which is now legal in nearly half the US, is emerging as a market opportunity for brands and broadcasters alike.

Do you work in the Marketing, Media & Advertising industry? Get business insights on the latest tech innovations, market trends, and your competitors with data-driven research.

The following is a preview of one Media, Advertising, and Marketing report, the US Sports Gaming 2021. You can purchase this report here.

The legalization of sports gambling in more than 20 US states has opened new business opportunities, and potential pitfalls, for broadcasters and streaming services that seek to tie in betting content, such as fantasy leagues, with live broadcasts—or at least market separately to the sports viewing and gambling audiences.

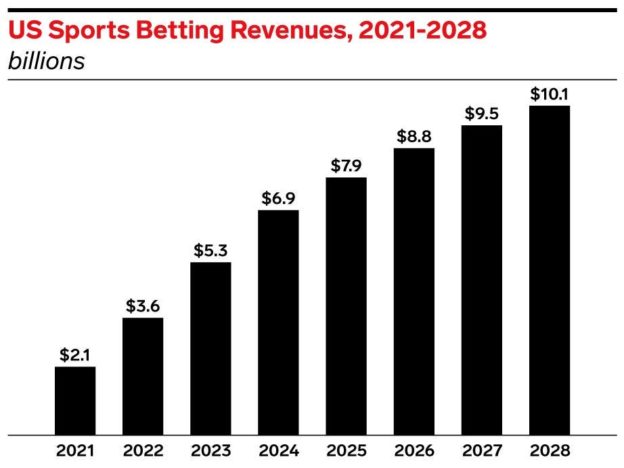

Legalized sports gambling in the US will generate $2.1 billion in revenues this year.

Insider Intelligence

The American Gaming Association (AGA) keeps a running tab of US states where sports gambling is legal, along with ones where betting has been legalized but is not yet live. It also tallies states with active sports gambling legislation as well as those with no legislation or dead legislation. As of May 2021, sports gambling was legal and active in 21 states plus the District of Columbia. An additional six states had legalized betting but did not yet have live services, and 14 other states had active pre-filed legislation aimed at legalization. Only 9 US states had either no legislation or dead legislation at that time.

A study by research and brokerage firm Gabelli Securities and the US Census Bureau estimates that legalized sports gambling in the US will generate $2.1 billion in revenues this year and projects growth to $10.1 billion by 2028.

Other companies predict even higher revenues from legalized sports betting in the US, with Morgan Stanley estimating a market size of $15 billion by 2025 and Macquarie Research forecasting $30 billion by 2030. In addition, MGM Resorts International projects that sports gambling will generate $13.5 billion by 2025, with 38 US states participating by that time.

Despite the discrepancies in those forecasts, which could result from differences in methodology, the takeaway is that gambling will produce significant new revenues for sports rights holders, as well as opportunities to integrate this content with traditional broadcasts and streams.

To that end, in March 2021, satellite TV and vMVPD provider Dish Network and gambling app DraftKings announced a deal that will incorporate DraftKings content into live sports games. Under the agreement, Dish customers with a Hopper receiver can use the DraftKings app to initiate bets, and then view live games that correspond with those bets on their TVs. The agreement also includes fantasy league content. Prior to the announcement, DraftKings ran two 15-second ads during the Super Bowl.

Another early entrant into the US sports gambling business is fuboTV, a sports-focused vMVPD. The company has market access licenses, pending regulatory approval, in New Jersey, Indiana, and Iowa, and is in advanced discussions with other states, according to co-founder and CEO David Gandler.

“Video and wagering are adjacent businesses and business models that work well with one another using the same demographic,” he said. “We’ve surveyed users on our platform and found that 20% of fuboTV viewers bet on a regular basis, and 22% are willing to place bets on fuboTV in a seamless experience. So that’s overindexing on the number of people that would like to play.”

Jason Wiese, senior vice president and director of strategic insights at the Vab (formerly the Video Advertising Bureau), is also a sports gambling enthusiast. He said, “I’m personally very excited about legalized sports gambling. It’s another way to engage fans and entice younger adults to come into sports franchises. In our research, we found that 26% of adults ages 25 to 34 are more likely to watch more sports if they’re gambling within sports.”

In another sign of the momentum of sports gambling in the US, the 19 regional sports networks owned by Sinclair Broadcast Group were rebranded to Bally’s in an agreement between the broadcaster and the casino operator.

These initiatives notwithstanding, some experts are cautious about the nexus between sports and gambling.

“Gambling in general is a sensitive topic for brands and advertisers,” said JoAnna Foyle, senior vice president of inventory partnerships at The Trade Desk. “Regardless of legality, it’s just not typically a place that some of the more conservative brands want to be. That’s not to say there won’t be participation or that gambling won’t attract more advertisers, but at least with the biggest brands, there are question marks.”

In late 2020, the AGA tried to get in front of brand safety and other concerns by forming a compliance review board to enforce the association’s Responsible Marketing Code for Sports Wagering. The project was inspired partly by the experiences of European countries with sports wagering, where in some cases, countries implemented advertising crackdowns in response to complaints about ads being served to underage customers or other inappropriate uses of gambling-related marketing.

It’s too soon to gauge how the convergence of gambling and sports will play out in the US, but early indications point to a lucrative market with potential pitfalls—not unlike social media companies, which have had to balance their financial success with concerns around the suitability of their content and marketing practices.

Interested in getting the full report? Here’s how you can gain access:

Join other Insider Intelligence clients who receive this report, along with thousands of other Media, Advertising, and Marketing forecasts, briefings, charts, and research reports to their inboxes.

Read More

Comments are closed