Summary List Placement

This is a preview of Insider Intelligence’s second annual UK Mobile Banking Competitive Edge Study, available exclusively to enterprise subscribers.

In addition to mobile banking coverage, Insider Intelligence publishes thousands of research reports, charts, and forecasts on the Banking industry. You can learn more about becoming a client here.

The UK’s top banks are in a fierce battle to offer the most innovative mobile banking features to current and prospective clients, as the coronavirus pandemic has shifted more customers online.

In Insider Intelligence’s second annual UK Mobile Banking Competitive Edge Study, exclusive data shows that 68% of all UK respondents surveyed use mobile banking. Of those that use mobile banking, 86% said mobile was their primary banking channel and 62% said they would even change banks if the mobile banking experience fell short.

UK banks are cognizant of this large base of mobile-oriented customers and are expected to spend a staggering £14 billion ($17.5 billion) on technology in 2020. For example, in its latest annual report, NatWest Group spoke of its continued investment on mobile and online channels as part of its digital-first strategy, and said this includes “releasing new mobile app features to help customers create savings goals, lock and unlock their debit card, and take control of their spending.”

In the UK Mobile Banking Competitive Edge Report 2020, we take a deep dive into this trend by benchmarking the 10 largest digitally focused financial institutions (FIs) offering zero-fee current accounts in the UK on whether they offer the mobile features customers say they care most about.

This 74-page report draws on two exclusive data sources: a benchmark of the 10 largest UK FIs by 41 mobile banking features and a UK consumer study on the desirability of each of those features. This research gives digital teams a data-driven look into which highly in-demand features, like ordering a replacement card, they should focus their attention on. On the other hand, it also spotlights which features should be deprioritized, by showing that conversing with a conversational assistant has minimal consumer demand, for instance.

Here are a few key takeaways from the report:

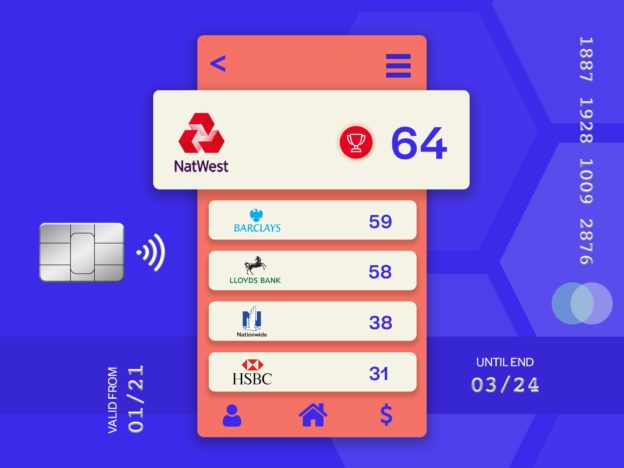

NatWest has the most desirable mobile banking feature set in the UK. The bank offers industry-leading digital money management and alerts capabilities. Barclays came second with competitive security and transfers features, while Lloyds followed closely behind, rounding out the top three.

Security features were the No. 1 priority for consumers. For example, our study’s top two most in-demand features out of a list of 41 — the ability to order a replacement card in-app and put a temporary hold on a credit or debit card — fell under this category.

Mobile account management features are also highly sought after by the UK mobile banking users in our study. This section includes capabilities that allow customers to conveniently set their preferences and handle important housekeeping tasks. Banks could stand apart from competitors by meeting strong customer demand for traditional account management features, such as the ability to activate a new debit or credit card and select paperless statements — something only half of banks studied currently do.

Customers also crave digital money management features. This section includes features that empower users to improve their financial health, including the ability to view recurring charges and set spending limits for their debit or credit card. The ability to cancel subscriptions, such as for Netflix, was called “extremely valuable” by 38% of respondents and was the section’s most in-demand feature.

In full, the report:

Shows how 41 features, selected to be rare and attractive to customers, stack up according to how valuable respondents in our survey actually say they are.

Ranks the top 10 digitally focused UK FIs that offer zero-fee current accounts on whether they offer each of those features.

Analyzes how demographics skew demand for different mobile features.

Provides data-driven strategies for banks to best attract and retain customers with mobile features.

The full report is available exclusively to Insider Intelligence enterprise clients. In addition to our UK Mobile Banking Competitive Edge Study, Insider Intelligence publishes a wealth of research reports, charts, forecasts, and analysis of the Banking industry. You can learn more about accessing all of this content here.

Insider Intelligence’s Mobile Banking Competitive Edge study includes: Barclays, Co-operative Bank, HSBC, Lloyds Banking Group (Lloyds, Halifax, and Bank of Scotland), Metro Bank, Nationwide, NatWest Group (NatWest, RBS), Santander, TSB, and Virgin Money.

The survey data for this report comes from Insider Intelligence’s UK Mobile Banking Competitive Edge Survey 2020, which was fielded between May 16, 2020 and May 26, 2020 — 1,100 UK respondents were asked to rank the value of 41 innovative mobile banking features. Respondents to the survey were mobile banking users selected to align with the UK population on the criteria of gender, income, and age.

Join the conversation about this story »

Read More

Comments are closed