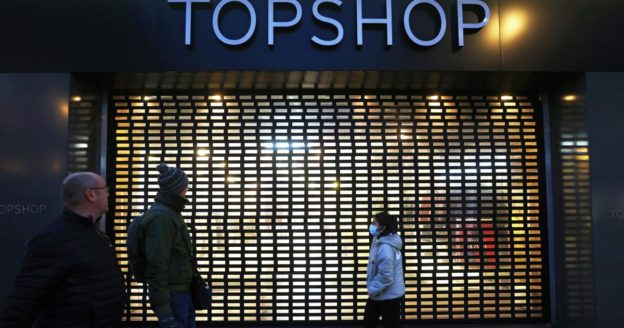

Arcadia Group, the retail empire of British tycoon Philip Green and parent company of fashion chain Topshop, has gone into administration, the British equivalent of bankruptcy, creating a dire situation for some 13,000 workers whose jobs are at risk. The company is not announcing any layoffs yet, and its brands, which include Topman, Miss Selfridge, Dorothy Perkins, and more, will continue to operate while it seeks buyers for all or some of its assets, the Guardian reports.

The immediate culprit behind its collapse is Covid-19, which has shut stores and battered fashion sales in the UK. Earlier this year, Arcadia was forced to furlough staff (paywall) and slash executive pay. The disruptions have continued as new cases surged and England entered a second lockdown on Nov. 5. “You don’t know when you’ll be open, you don’t know what stock to buy,” a senior source at the company told the BBC.

But the pandemic put pressure on a structure that was already cracking. It’s a common theme at this point. In the US, for example, numerous companies including J.Crew, Neiman Marcus, and Brooks Brothers have filed for bankruptcy protection due to Covid-19, but prior to the pandemic all had struggled to adjust to a retail landscape being reshaped by changing shopper preferences and e-commerce. Arcadia, once a mighty business that dominated the British high street, has been similarly floundering. The culling of weak retailers due to Covid-19 that was predicted by experts is now playing out.

Arcadia tried to avoid administration, saying in a Nov. 27 statement only that the pandemic had a “material impact” on its business and that it was “working on a number of contingency options to secure the future of the Group’s brands.”

But the decision proved inevitable. “Covid-19 has resulted in a Darwinian shakeout for mid-priced retailers on the British high street,” Nina Marston, fashion and luxury analyst at Euromonitor International, a company that provides market research, said in an emailed statement.

Before the crisis, spending on fashion and footwear in the UK was slowing, according to Euromonitor, while more competitors had entered the market. Ultra-fast online retailers such as Boohoo, Missguided, and Pretty Little Thing proved adept at delivering the sort of trendy, cheap fashion customers once sought at Arcadia brands like Topshop. “Arcadia Group has suffered against these emerging players because the company was slow to develop an innovative and user-friendly online offering as well as a strong brand narrative and social media presence,” Marston said.

Arcadia also depended heavily on department store Debenhams, deriving an estimated 15% of total sales across its brands from the business and its nearly 200 shops. But Debenhams has faced its own challenges. Last year it had to restructure and close a number of stores. It continues to suffer.

The challenges at Arcadia have extended beyond the UK. In 2019, it filed for bankruptcy protection in the US and announced it would close its 11 Topshop and Topman stores in the country. It cited rising online competition and intense discounting among retailers vying for customers as reasons for its US stumbles.

Arcadia’s collapse could lead to a selloff of its brands, including Topshop, potentially to competitors such as ASOS, Next, or Boohoo. It could also doom Debenhams, threatening as many as 27,000 jobs across both companies.

In an editorial, The Guardian called it a “retail emergency” for the UK. The industry was already in bad shape after recording a drop in sales in 2019, resulting in its worst growth on record. Covid-19 is now thinning the herd.

Update: This story has been updated with Arcadia’s announcement that it has entered administration.

Comments are closed